Artificial Intelligence has seen massive and rapid development through extraordinary advancements of various neural platforms commonly referred to as ‘Machine Learning.’

Read More

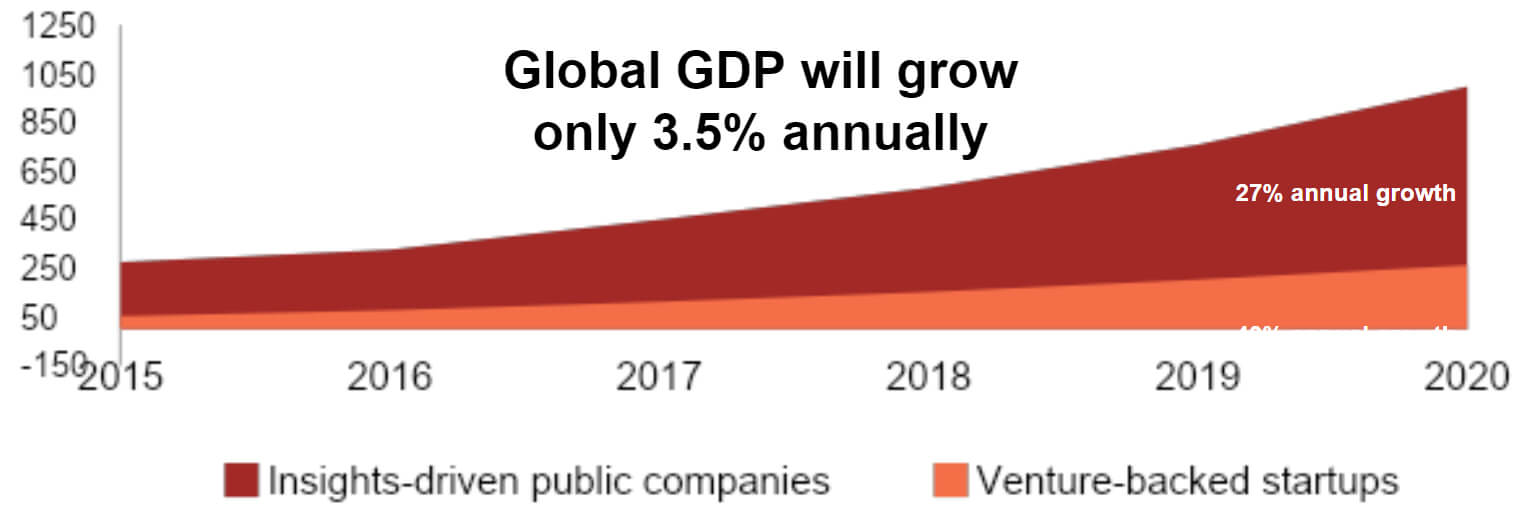

The AI market is developing on the growth of big data

Artificial Intelligence has seen massive and rapid development through extraordinary advancements of various neural platforms commonly referred to as ‘Machine Learning.’

The rapid uptake of AI in end-use enterprises such as retail and business analysis is expected to grow substantially.

The AI market for services and manufacturing continues to grow at the highest CAGR with North America holding the largest market share, with APAC markets demonstrating the highest growth.

Artificial Intelligence in Market by Offering (Hardware, Software, and Services), Technology (Machine Learning, Context-Aware Computing, NLP, and Computer Vision) was valued at USD $5 Billion in 2017 and likely to reach over USD $40 Billion by 2025, at a CAGR of nearly 30% during the forecast period.

Revenue forecast of insights-driven business ($ billions)

Our Target Market

Junior (and many mid-size) mining companies lack the financial capacity to fund mine development and need to raise additional equity. For this reason, junior companies often sell a promising project to a larger company.

Despite their small size, junior companies are responsible for the majority of exploration expenditures worldwide.

As equity financing is the typical driver for mineral exploration, Windfall Geotek views junior to mid-size miners as ideal partners to introduce innovative practices and economics to the investment community in order to propel projects of merit.

Canadian Markets Play A Major Role

Over 40% of publicly reported equity transactions since 2011 occurred on Canadian exchanges and increased for three consecutive years to a decade high of ~50% in 2018. But the total number of transactions declined by ~22% from 2017 to 2018, coinciding with a 33% decline in equity funding value.

Our model is an opportunity for financing initiatives predicated on leveraging innovative & disruptive technological advantages.

| Producers | $ Million |

|---|---|

| Yancoal | 2 496 |

| Sibanye-Stillwater | 1 000 |

| Nexa Resources | 328 |

| Alamos Gold | 250 |

| Agnico Eagle | 220 |

| Builders | |

| Heron Resources | 134 |

| Heron Resources | 113 |

| Syrah Resources | 86 |

| Dacian Gold | 84 |

| Pilbara Minerals | 62 |

| Developers | |

| Arizona Mining | 81 |

| Osisko Mining | 73 |

| Dalradian Resources | 61 |

| Bluestone Resources | 61 |

| SolGold plc | 59 |

| Explorers | |

| Auryn Resources | 31 |

| First Cobalt | 23 |

| Integra Resources | 21 |

| New Pacific Metals | 21 |

| Sulliden Mining | 18 |

Mineral Exploration: Fortunes Go to the Few

Discovering new sources of minerals, such as base metals, gold, or even cobalt, can be notoriously difficult but also very rewarding.

According to industry sources, the chance of finding a new deposit is around 0.5%, with odds improving to 5% if exploration takes place near a known resource.

On the whole, mineral exploration has not been a winning prospect if you compare the total dollar spend and the actual value of the resulting discoveries.

Windfall Geotek aims to improve the odds. Work smarter not harder.

Historical Figures in 2014 dollars. (Source: MinEx Consulting, March 2015

| Region | Exploration Spend | Est. Value of Discoveries | Value/Spend ratio |

|---|---|---|---|

| Australia | $13 billion | $13 billion | 0.97 |

| Canada | $25 billion | $19 billion | 0.77 |

| USA | $10 billion | $5 billion | 0.48 |

| Latin America | $33 billion | $19 billion | 0.57 |

| Pacific/SE Asia | $8 billion | $4 billion | 0.49 |

| Africa | $20 billion | $23 billion | 1.19 |

| Western Europe | $4 billion | $2 billion | 0.42 |

| Rest of World | $27 billion | $8 billion | 0.32 |

| Total | $140 billion | $93 billion | 0.57 |

Windfall Geotek Financing

We put skin in the game.

Our Windfall AI System platform, has been developed to facilitate our clients’ efforts and make the process of discovery faster and more efficient.

In many instances, Windfall Geotek uses public data to process and identify projects as part of an ongoing internal program to find new projects. Within these internal projects, 80% of the targets will have been claimed by different companies. We contact those companies and introduce some of the data we have uncovered and invite them to consider participating in the validation of the targets together.

Windfall Geotek may offer investment as part of this approach. We put skin in the game by putting our expertise, technology and capital in play to validate targets that we believe in.

<

<